![]()

Small Business Startup Checklist.

Small Business Startup Checklist to help you launch your first business, with serial entrepreneur Henry Lopez. Henry explains the primary steps involved with starting your first small business and realizing your dreams of entrepreneurship.

Free Download: Small Business Startup Checklist

The Small Business Startup Checklist includes these steps and considerations:

Are You Ready?

- Starting your first small business starts with determining if you are ready. And if you are not ready now, then what do you need to do to get there. The question you have to answer for your self is: Are are ready, willing and able to start your small business? You have to be mentally and emotionally ready, you must be willing to sacrifice the time and effort required, and you must be able to afford the investment of time, money and energy.

- Related Episodes: Are You Ready

- Free Download: Ready, Willing and Able

- Related Resource: Starting Your Business – Are you ready? – an online self-paced focused on helping you determine if you are currently ready, willing and able to be your own boss. And if you are not ready now, you will have a clear understanding of what you need to launch your first business.

Start with WHY?

- Before you start your first small business, you want to have a clear understanding of why you are doing so. What is your vision or purpose? How will this business help you achieve your lifestyle goals?

- Related Book: Start with Why: How Great Leaders Inspire Everyone to Take Action by Simon Sinek

Ideation – Your Small Business Idea:

- The Ideation phase includes the creative process of generating, developing, and communicating new ideas for a potential small business concept. The most common and difficult question related to ideation is: Is my small business idea a good one, and will it be a successful business? Of course, that questions is impossible to answer. Only the market will eventually determine if it’s a good idea and your business model and execution will greatly determine if your business will be successful and profitable.

- Related Episodes: R4 – Ideation – Small Business Idea Creation & Development

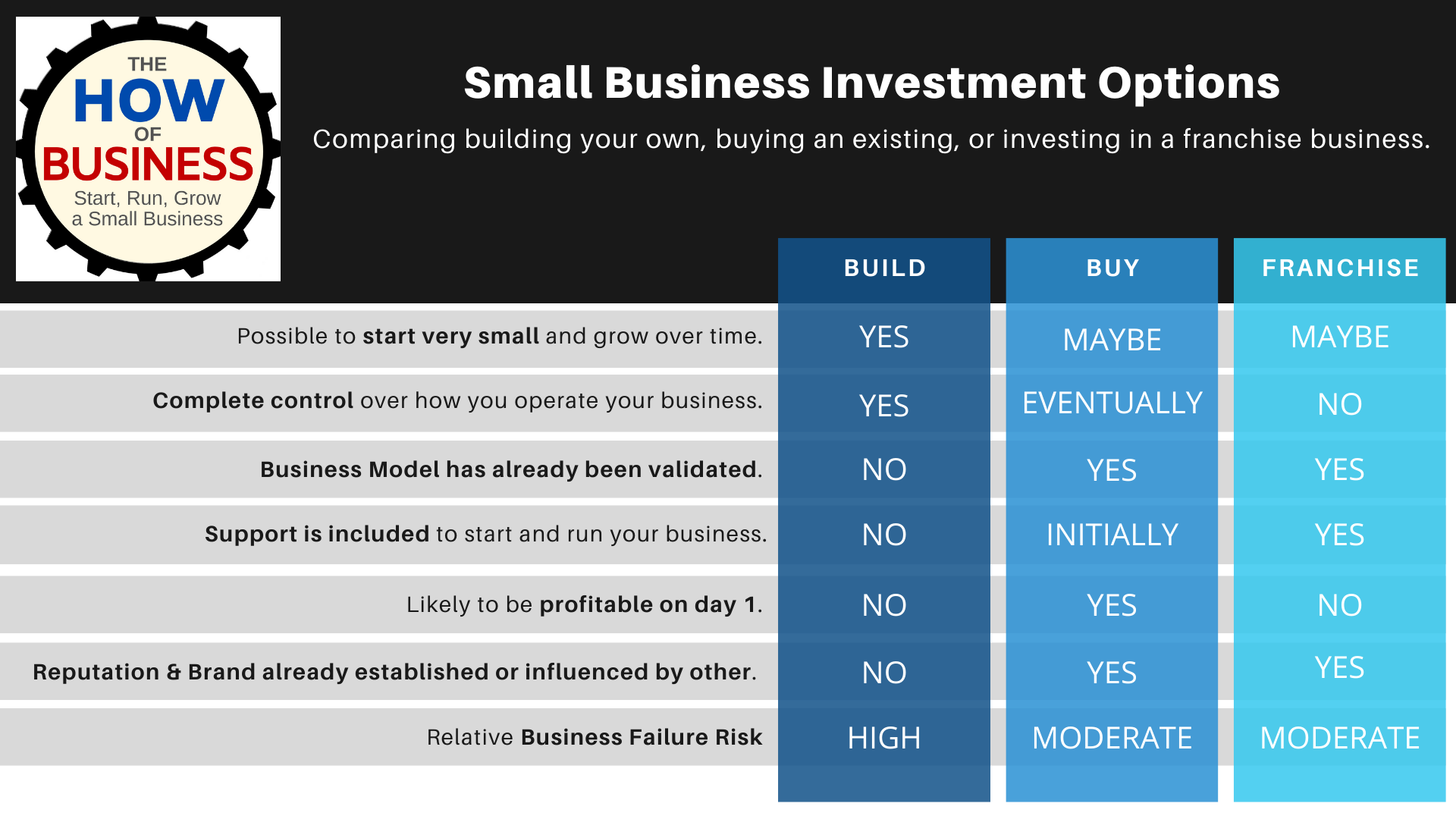

- The options for realizing your business idea include:

- Build Your Own – create your own small business yourself. This option offers the most control, but also potentially the highest risk.

- Buy – purchase an exiting successful small business. Provides an opportunity to invest in a proven and profitable

- Franchise – invest in a franchise small business (either a new location or purchase an existing franchise location). You may not have complete control over how you operate your business, but the business model and systems have been developed and proven.

Small Business Plans:

- Your small business plan organizes and explains your plans for a new business. A good business plan not only helps you focus on the specific steps necessary to make business ideas succeed, but it also helps you achieve short-term and long-term objectives. It also helps to create some order from the chaos that is part of starting a new small business. It helps you communicate your business idea to others, and validate your business model.

- Don’t allow yourself to become overwhelmed and paralyzed by the misconception that you have to produce a long elaborate business plan. Initially, you (and potentially your partners) are the only readers of your plan. So get started with a simple outline, and complete sections of your plan over time.

- Related Episode: 382 Business Plans

- Related Episode: 351 – Niche Down to Grow Your Small Business

- Financial Projections are perhaps the most important part of your Business Plan.

- Related Episode: 395 – Financial Projections for Business Startups

- Free Download: Business Plan Outline

- Free Download: Financial Projections Spreadsheet

Join Henry Lopez for the next “Start Your Small Business” Workshop: learn more and register

Marketing Plan:

- Your Marketing Plan for your small business (included in your Business Plan) details your branding, target market, go-to-market plan, and initial marketing campaigns.

- Related Episodes: Marketing Episodes

Business Partners:

- If you decide to have equity partners in your business, you must agree to an Operating or Partnership Agreement before you start the business. Partnerships can be a great way to combine skills and efforts to start and build a successful business. But partnerships can also be fraught with disagreements that could lead to the failure of your small business. Before you enter into a business partnership use the following checklist and discuss all of the possible situations that may arise in the future, ant then you must consult with an attorney to draft and execute a comprehensive Operating or Partnership Agreement.

- Free Download: Memo of Understanding for Business Partnership

- Related Episode: 259 – Small Business Partnerships

Small Business Funding:

- After completing your Financial Projections you will know how much money you will need to start your small business.

- Related Episodes: Money & Lending Episodes

Your Virtual Team:

- To get your small business started you will need the assistance of a team of professionals, including: A small business attorney, a small business CPA or Accountant, Commercial Real Estate Broker (if you will need physical space), Commercial Insurance Agent (to help you with the liability insurance coverage you will need for your small business), Banker (if you will seek bank loans).

Business Name & Legal Entity:

- You will need to select a unique name for your small business. You should search online, at your state website, and on the federal trademark website to confirm that you have a unique name.

- Related Episode: 306 – Naming

- You will need to get the advice of a CPA or Tax Attorney to help you determine the right type of legal entity for you and your business. We strongly recommend against operating as a Sole Proprietor because of the potential liability exposure.

- Related Episodes: Legal Episodes

Accounting Systems:

- You should select a financial system like QuickBooks to help you manage your financial data.

- Avoid commingling of funds between your personal transactions and those of the business.

Initial Launch:

- Opening the doors to your small business includes finalizing your lease and finish-out, or your online platform.

- You will need to hire your employees or contractors if required.

- Related Episodes: Employee Episodes

- If you invest in a Franchise, the franchisor should guide you through this startup process.

- If you are able to take an MVP approach to your small business launch, then learn from your initial launch quickly, adjust or pivot and iterate as you grow you validate your business model and build your small business.

Get Help from Coaches and Mentors:

- We encourage you to seek the help you need as you plan, start and grow your small business. This help will come the professionals listed about who are part of your virtual team, but should also include a coach or mentor.

o My one-on-one coaching program – schedule a free consultation with me.

Transcript:

The following is a full transcript of this episode. This transcript was produced by an automated system and may contain some typos.

0:00:11.7 HENRY LOPEZ: Welcome to The How of Business podcast. This is Henry Lopes, and on this episode, I’m going to share with you my small business startup checklist. I’m going to explain the primary steps involved with starting your first small business, I suggest listening to this episode to get an overview of what’s involved, and then I encourage you to download the free checklist and learn more about each step in the process.

0:00:32.3 HENRY LOPEZ: It doesn’t include every single step, but it’ll give you at a high level, the primary steps involved with starting your first business to receive more information about the how business, including links to the show notes page for this episode and the free small business start-up checklist.

0:00:48.0 HENRY LOPEZ: Please visit the TheHowOfBusiness.com. Let’s start with the question, Are you ready? I’ve done several episodes, a whole series of episodes, this in fact on this topic, because I think it’s so critical that you start with assessing for yourself at this point in time, how ready are you in fact to start your first business? And if you’re not, then what do you need to do to get ready to realize your dreams of becoming a business owner?

0:01:11.2 HENRY LOPEZ: And I break this question down, Are You Ready into three parts are you ready, willing and able?

0:01:17.0 HENRY LOPEZ: Let me share a bit more about what I mean by ready, willing, and Abel ready is about determining if you are mentally and emotionally ready to start a small business, what I find is often what holds people back from starting their businesses, one or a combination of two things, their first one is a mindset issue to a great extent, which is, Are you afraid of the fear of the embarrassment of failure, in other words, if the business happens to fail or if you’re afraid it might fail, then you might be embarrassed to tell your friends or your family, and to admit that you tried something, you took this risk and it failed, that fear of failure, that unknown, that inability to know for certain that your business is going to be successful. That’s what holds a lot of people back.

0:02:00.4 HENRY LOPEZ: So you have to get over that fear of failure and not a potential embarrassment, that’s a mindset issue

0:02:06.7 HENRY LOPEZ: Separately, of course, is the fear of the financial impact of a failure, and that has real impact on perhaps you and your family, and you have to assess that. That’s why one of the steps in this checklist is to make sure you start as small as possible and with the right level of investment, so that relative to your financial risk, if the business fails, it doesn’t ruin you financially.

0:02:30.1 HENRY LOPEZ: But that’s the first step. Determining if you are mentally and emotionally ready, of course, you’re going to plan to succeed, but we have to be prepared for failure and small business, because no one can really predict if your business idea or a business model will be successful. We’re going to work hard to make it so. But there are no guarantees. So

0:02:49.6 HENRY LOPEZ: How do you feel about that fear and have you overcome that if you don’t face that first and overcome that mindset issue, than what you’ll find is you’ll keep delaying, you’ll talk about it, but you won’t take any action to getting your business launched. The second part of it is, are you willing? Are you willing to put in the time and effort that it takes to start a new business, your success in starting your small business, as with many things in life is going to be directly proportionate to your discipline and to sacrifice…

0:03:19.7 HENRY LOPEZ: What are you willing to sacrifice

0:03:21.5 HENRY LOPEZ: And are you willing to delay gratification to get to that end game, that end goal that you have for your business and why you want to start a small business? Primarily, I think one of the things that people struggle with the most here is being realistic about what you need to sacrifice, often it’s those other things that we do with our time and energy and perhaps our money that we might need to change so that we can focus that effort, that energy and that money onto starting our first business, so what are you willing to put in in a way of time and effort to get your first business started, and then thirdly, is the question of, Are you able to afford the investment of time, money and energy, some of it relates back to the point I just made about sacrificing to make the time available to invest in this business.

0:04:10.7 HENRY LOPEZ: But when it comes to the money part, the fact is that it will take some money, some of your own money to start a business, that’s one of the reasons, of course, I encourage people to start as small as possible, and we’ll talk about that in this checklist, so that you can put forth the money that you do have and then grow over time or bootstrap, but you also have to have the energy, and a lot of that has to do with where you are. Mentally as well as your overall health.

0:04:34.4 HENRY LOPEZ: We really do need to be in a state of mind and in a relatively healthy position to be able to put in the energy that’s required to start a business, so are you able to afford the investment of time and money and energy? So all of these three things is I break down this question of, are you ready? Is what I want you to think about an answer. First, as you move forward to starting your first business, I encourage you to have and make an honest and mindful assessment in determining if you are ready, willing and able to start your business now, and if you’re not, it’s not that you can’t start a business, but you might have to delay or slow down and get some things in order first, perhaps you need to get your personal finances in order first, or raise your credit score or save some money, all of those things, you need to make an honest assessment first before you move forward with starting your first business, I have a free resource for you on this topic, it’s a free download that you can find in the show notes page for this episode at the holiness dot com, and it goes into more details for you to assess and learn about determining if you are ready to start your first business, so I encourage you to download that and read more about this topic, I also wanna invite you to take advantage of a special offer to an online course that I’ve developed, it’s called starting your business.

0:05:51.2 HENRY LOPEZ: Are you ready? And in this self-paced online course, it walks you step-by step to this assessment, including a score card that help you very clearly identify where are you ready, maybe where you need to invest some more time and research and energy and give you a road map. It’s gonna lay out a clear road map for you to get there, so if this is where you’re at in the process, I encourage you to take advantage of this special offer. You can find a coupon code that will get you 30% off of my starting your business. Are you ready? Online self-paced course. Again, just go to the show notes page for this episode at the how of business, you’ll find the coupon code there and the link to register or to learn more about this online course. On episode 339 of the Halo business, I had a wonderful opportunity to interview Gino Wickman, Gino Wickman is an entrepreneur and the author of several books, as well as the creator, the co-creator, I should say, of the entrepreneurial operating system, and he’s written books like traction, which is one of the top recommended books on this show, as well as his most recent book, or one of his most recent books, entrepreneurial leap, and so on that episode, episode 339, I interviewed Gino about this book, which is all about the Termini…

0:07:05.0 HENRY LOPEZ: Do you have what it takes to become an entrepreneur?

0:07:07.4 HENRY LOPEZ: So again, to finish up on this topic of, Are you ready? This is another great place to start, I recommend a book, I recommend at least listening to the episode, and there’s several tools that he offers for free to help you determine if you’re really cut out to be an entrepreneur, or if not necessarily an entrepreneur, a business owner, and what type of business might be a good fit for you?

0:07:29.4 HENRY LOPEZ: I’ve done a series of episodes related to entrepreneur or leaf and helping you determine if you have the six essential traits that are required to be a successful entrepreneur as per Geno, and then walk you through an assessment, he offers a free assessment tool to help you determine that, and then a Bismuth tool to help you determine what type of business might be a good fit for you, so once you’ve determined that you’re ready, or a part of helping you determine that you ready is to, of course, come up with a business idea and beginning then to determine if that business idea can be delivered on a business model that is profitable, will break those two things down, but the whole idea process, what I call and what people call the ideation process is another topic that I’ve covered on various episodes on this podcast, and so I encourage you to go and listen to specifically Episode 4 on ideation. I’ve interviewed several people, and I’ve chatted about this on the podcast multiple times.

0:08:24.6 HENRY LOPEZ: And

0:08:24.7 HENRY LOPEZ: One of the big questions, of course, probably the top question I get as it relates to business ideas, is mine a good business idea? Well, nobody has the answer to that question. If we knew, then we’d automatically move forward and start our business, the reality is that we don’t know, we don’t know until we put our product or service out there in the market and see if people will respond and pay us what we thought they would… That we then validate if we’ve got a good idea, so don’t ever let anybody tell you that the idea is no good, what you need to do is go through a process of perhaps trying to project and validating, and then an iterative approach and MVP approach to test in a smaller version as possible of this idea, to in fact validate for yourself that it’s a good idea. I had an opportunity to interview Norman Crowley, who is a serial entrepreneur, and we chatted on episode 394 of it, about this topic of business ideas, and he has the belief that I agree with, which is that the ideas are relatively speaking the easy part. I’m not saying that coming up with a great idea is necessarily easy, but the hard part is the execution, that’s the hard part, and again, this fallacy of thinking that you’re going to develop in your mind or on paper, the perfect idea and the perfect business, and then that automatically will be successful, instead, we have to start small and validate our business idea.

0:09:51.2 HENRY LOPEZ: So as you develop your idea, listen to those episodes if you haven’t already and begin to apply to it a business model, there’s two separate things, and the idea is this idea for a product or service and your unique approach to how you’re going to deliver it, if it is being delivered already or perhaps it’s a completely new idea. And the business model is How will you operate that business to make a profit? Delivering that product or service that you have an idea for. Related to this on the checklist is determining your personal… Why…

0:10:22.4 HENRY LOPEZ: My favorite book on this topic that I always recommend is Start With Why by Simon Sinek, and so that’s a book that I recommend that you read, even if you think you’re clear on what your vision or purpose is for the business, because it’ll help you understand from a business perspective and a personal perspective, how to establish that because what you’re going to find… Certainly, what I have found in other business owners have found.

0:10:45.7 HENRY LOPEZ: Is that if your vision or your purpose is it clear if you’re a long-term goal as to where this business is taking you, how it’s serving you in your life or the life that you want to achieve the lifestyle that you want to achieve, I should say. Then you’re not going to be able to get through the hard times. You need that, you need that vision to fight through the challenges of starting and running a business so that it makes sense for you and so that it’s in alignment with your purpose. Another thought on business ideas is that you have to start thinking about breaking it into one of these three categories, generally speaking, and I’m going to have a comparison infographic that you can download at the show notes page for this episode at the holiness dot-com.

0:11:29.6 HENRY LOPEZ: But essentially you have three choices, you can build your own business, so you’re going to create it from scratch, so you’ll develop the brand, the idea, and it doesn’t mean it’s a brand new idea, it could be a different version of an existing idea, but it’s your business, your idea you’re going to develop it from scratch, from the branding to the processes, to how you’ll go to market, to the marketing plan, all of it, you’re going to build yourself… That’s one option.

0:11:55.7 HENRY LOPEZ: And that is a common option for a lot of people, if for no other reason, then we have that pride of authorship that we want to create our own thing, the second option is to buy an existing business that serves the market that you wanna serve or is already offering a product that you believe in, and you believe you might be able to make that business better perhaps.

0:12:16.4 HENRY LOPEZ: So you might buy an existing business, and there’s lots of opportunities in data, Rena, lots of businesses for sale. And there’s various episodes that I’ve released as well on the topic of considering buying a business.

0:12:28.4 HENRY LOPEZ: And then thirdly, which is can be a variant of both really. But that’s a franchise.

0:12:33.7 HENRY LOPEZ: So buying a franchise, we’re not inventing everything from scratch, that’s what we’re investing in, in fact is someone else has invented this thing and the business model and is ideally proven that it is profitable and then you’re going to open your own units… It has its own risks, of course, ’cause there’s no guarantee with their franchise, but you start with someone else’s model and leverage that to get started in business, and you can find a whole series of episodes on franchising, just go to the archives page for the podcast at my website and click on franchising, you’ll find their whole series of episodes I’ve done on this topic. The key takeaway on this item is deciding which way do you wanna go, or do you want to go with your business idea, do you want to create your own, buy an existing business or perhaps start a franchise unit, and now we arrive at the step that I find is really a stumbling block for a lot of people. This is where people hit a wall and then stop making progress on starting their first business, and that is in developing your business plan, and I think that one of the primary reasons why people get hung up here is that they think they have to write this elaborate 100 page or so business plan, and then they worry about the writing and who’s going to read it and is it well written, and I don’t know what to include in it, and so they get hung up there.

0:13:53.9 HENRY LOPEZ: And so what I recommend is that you look at this as creating a business plan, a version at a time, and that initially the only audience for your business plan is yourself and perhaps your partners early on, eventually you might have to create a version of your business plan that you share with a lender or an outside investor, but initially don’t let that be a road block, it could simply be an outline, it could simply be hand-written notes as a starting point. I break down the business plan on an episode that I did on just on business plans, and that’s episode 382 of the hour business. So if you haven’t already, I encourage you to listen to Episode 382 to learn all about business plans as well as on the show notes page for that episode, and I’ll put it on this episode show news page as well, is two free downloads. One is an outline for a business plan that will give you what I believe are the major sections, the major components of an effective business plan, but again, when you look at that outline, don’t think you have to complete all of that all at once, you’ll do it a section at a time as it makes sense as you progress with developing your business plan, and also I’ve included a lean canvas plan version that is a one-page version that I really like is an approach early on in the process…

0:15:08.7 HENRY LOPEZ: Early on in the process of developing your idea and your business model, that’s a great way, it’s a one-page version of a business plan that will help you make tremendous progress in developing, articulating and validating this idea that you have for a business. So part of business planning is all of the market research and analysis that you have to do, I say that you can never do enough research and analysis, now you don’t wanna be like me sometimes and get paralyzed by the analysis. There is a point at which you have to move forward, but the more research you do, the more you understand the target market that you’re planning to serve, the more you understand that industry, the more you learn about it, the more you learn about competitors and the types of people that you’re trying to serve and why they use those competitors, all of that is invaluable information, so all along the process you’re learning and submerging yourself in that topic in that industry and that business idea. So that you’re learning as much as possible. You also wanna learn about government requirements, do I need a license or a permit, are there…

0:16:13.7 HENRY LOPEZ: Restrictions are in the type of business that I’m considering. In particular locations that I might be considering, I need to think about if I’m going to make a physical product, how and where will that be manufactured and that whole process, how will it be distributed, how will you get to market related to that is pricing and sales, what we… Our sales model, we will be a direct to consumer or some other model of distributing and selling your product, and then overall, as I’ve mentioned already, is to think about taking an MVP approach, MVP stands for a minimum viable product, and essentially all it means is take this business idea or a vision that you have. And scale it all the way down niche down to the smallest possible initial iteration, which would be MVP 1 of your business, and what that allows us to do is to validate business model, validate that there in fact is a market that’s willing to pay for your product or service by having only put in the minimal amount of investment such that it gives you a lot more flexibility to adjust, to pivot, to perhaps retract all together without having lost all of your investment and then not being able to do anything else but to go maybe go back and find a job at that point in time, so take that approach, niche down.

0:17:32.1 HENRY LOPEZ: I did a whole episode on this topic of niche down, and I’ll have a link to that episode on the show notes page as well. So that’s where you start with your business plan. Other components that are very important to the business plan or the marketing plan, and that includes developing your elevator pitch, which is your ability to concisely articulate what is this business idea and business model that you have… I find that if you’re not able to do that, it might be a signal that you’re not quite there in developing your idea, if you can’t clearly and succinctly articulate what the business is and how it will function, so I’ve got resources for you there as well in developing your marketing plan and in developing what’s called the elevator pitch, but the most critical component of the business plan, in my opinion, and have given us a lot of attention on the show as well as resources, is your financial projections. That’s again, in my opinion, the most important part of the business plan. And this is where you’re going to project your startup costs, what is it going to take to start this business, ideally that smallest first version that MVP one of the business.

0:18:39.3 HENRY LOPEZ: What is it going to take? What’s the investment? What are your projected profit and loss projections, your PNL projected at least for that first year on a monthly basis, and then perhaps three to five years beyond that, you’re going to seek a loan, perhaps you’ll need at least that much of a projection you want to calculate within your break even, which will let you know then how much working capital you need to get started and get through that ramp-up period until you start making a profit in the business and you want to calculate what’s the potential return on investment, these calculations will validate for you, at least on a projection basis, if in fact the business model makes financial sense, and this is one of the other biggest mistakes I see people make is they have a great idea, you’re passionate about it, you’re convinced it’s gonna be great because you are passionate about this particular product or service, but if you don’t take the time to project how in fact that’ll be a reality from a business model, from a financial perspective, then you end up possibly putting a lot of money into something that’s not going to make a profit or you end up unfortunately with a lower paying job than the one that maybe you have now, and that’s not what you’re looking for, so you’ve got to put some numbers to it to project and validate that the business model makes sense.

0:19:57.5 HENRY LOPEZ: So in episode 395, I do a deep dive on financial projections. So if you haven’t listened to episode 395, I encourage you to do so. That episode, and on that show notes page, but I’ll include it on the show notes page for this episode as well, at the holiness dot com is a free financial projection spreadsheet. So if you don’t know how to get started with creating that financial projection, download this free spreadsheet and it’ll give you a starting point, and then I am excited to announce that I’ve set the next states for the financial projections workshop. This is a recurring workshop that I do on a regular basis, but the new dates are announced, so go to the show notes page and learn about that, I limit that workshop to just 10 participants because it’s an interactive live workshop where I spend 90 minutes walking you step by step through creating your financial projections, you’ll walk away from that workshop from that investment of time with a real good first version, at least of your financial projections and understanding some of these key concepts like calculating, break even, calculating how much working capital you might need, calculating your start-up expenses, and then calculating a potential return on investment so that you can determine if this business idea, if it has the business model that has a potential to be profitable.

0:21:19.4 HENRY LOPEZ: So what we’ve talked about, are you ready? And we’ve talked about your business idea and your why, or your purpose or your vision, I just explain the business plan, how important that is, and in particular, the financial projections component of the business plan

0:21:34.3 HENRY LOPEZ: Related to business planning next is determining where your business will exist, whether it’s bricks and mortar or an online platform.

0:21:43.0 HENRY LOPEZ: So you need to determine those things, and if you’re looking for a physical location, and I certainly encourage you to work with a commercial broker, a commercial real estate broker, they work just like a residential real estate broker, where you don’t pay them anything, they make a commission from the landlord if they’re able to help you sign a lease for your business, but that does bring me back to the idea of the MVP or niche down, if you can start a version of your business that does not require you to sign a lease for five or 10 years, then try to do that first before you walk yourself into at least if it’s an online business, and of course, you’ve got to determine what platform you’re gonna be on, is it a third party hosting platform or are you going to build your own website

0:22:26.6 HENRY LOPEZ: And then you have to think about… And this is part of the business plan as well, is funding. Where will the money come from? Now that you’ve done your financial projections and you’ve calculated your start-up expenses in your working capital, now you know how much money you need, so you have to determine then where is that money going to come from?

0:22:44.4 HENRY LOPEZ: And I’ve done a series of episodes, including most recently, an episode on funding, but if you go to the archives page again for the how a business podcast and go to the money and lending episodes, you’ll find a whole series of episodes there on money and lending, everything from SBA loans to perhaps crowdsourcing as a way to fund your start-up the next time I’m on the checklist is your team, and this is something that, of course, you will have addressed earlier, so it’s not necessarily here in chronological order, but it’s important to stop and think about your team and your team is your internal as well as your external or extended team, so are you going to have partners, and I’ll chat about that in a moment, but the team, the virtual team includes your CPA, which is critical. You’ll need a CPA to help you, especially in the initial phases and determining your legal entity and tax considerations that you need to think about, you’ll need an attorney, definitely if you’re going to have a partnership or if there are other special legal considerations. So those two people have to be part of your team, you’ll want to, of course, talk to and have a lender, If you’re going to borrow money, if you’re going to open a physical location, and even if it’s an online location, you might need insurance, so you’ll want to speak to a commercial insurance agent to make sure you get the coverage that along with your business entity will protect you and your business, and then of course, I have to recommend that you get a coach or a mentor, so you need to get help, and it’s okay, to get help at all business levels, including in my years of experience, I have coaches and mentors that helped me through making decisions, holding me accountable and having somebody to bounce ideas off of that has been through the same thing.

0:24:21.8 HENRY LOPEZ: If you wanna learn more about my coaching program, you can find a link to my one-on-one coaching program at the holiness dot com, and I encourage you to schedule a free consultation with me. So there’s no obligation. We’ll chat for about 30 minutes, we’ll get to know each other. I’ll try to address some of your key thoughts or questions that you might have, and then I’ll share with you how I work with my clients through a one-on-one coaching program that brings us to partnerships, if you are going to partner with someone else other than your spouse, then there’s a lot of things that you have to consider, and I’ve done several episodes on partnerships that I encourage you to listen to, including most recently episode 259, partnerships are great, but they can also be tricky. I prefer to work in partnership, but it’s not for everybody, and so you need to think long and hard about all of the ramifications, the biggest mistake people make is that they assume that the honeymoon period of the initial process, when everybody’s getting along, and we all seem to agree on everything, that that’s gonna last forever, and that we don’t have to put anything like that in writing.

0:25:26.7 HENRY LOPEZ: In fact, what I encourage you to do, and I have another free download Here is the memo of understanding, that’s been one of the most popular downloads on my site since I put it up there multiple years ago, and this what I call the memo of understanding is simply just another checklist to walk you through all of the topics and questions that you should go through with your potential partners now before you start business, and that’ll allow you to work through and decide how you’re going to arrange the partnership, the terms of the partnership, and then you’ll put that all into a partnership or operating agreement that you will need an attorney to help you put together and finalize and execute. Another step in the process is determining your business name and beginning to develop the branding, now that’s part of the marketing plan, of course, but at a high level, here are the steps that I usually recommend for selecting a business name, I had an opportunity back on Episode 306 to interview Brad Flowers, and he’s got some great tips on that episode on how to come up with the business name, one of the great takeaways is his idea is to brainstorm on names before you put any kind of rules on it, just brainstorm…

0:26:39.0 HENRY LOPEZ: And he’ll walk you through that process on that episode to come up with the business name, but it’s challenging because in a lot of industries and a lot of areas, all of the good or obvious names you might argue or already taken in particular, review. Consider that you probably want to have a website that the domain or the URL or the address is the same as your business name or as close as possible. So that makes it tricky. So I usually start with searching on a site like GoDaddy or other registry site to see of that domain name for this name that I’m thinking about is available, if it is, and

0:27:14.9 HENRY LOPEZ: I have usually I have… I start with your brainstorming list and narrow down to three to five finalists, make sure that the domain is available, sometimes if it’s one of the finalist names, I might go ahead and just buy the domain. It only cost 12 to 15 bucks, and I’ll just hold it for a year if I don’t end up doing anything with it… No big loss, but I do that you wanna search at the state level in your state, every state has a website that will allow you to search to see if that business name already exists.

0:27:44.2 HENRY LOPEZ: And then you can search the Federal trademark, that’s a federal database. And I have a link to that in the checklist download to see if that trademark, that business name has already been trademarked by someone else, so that’s the process at a high level. I used to select the name again, listen to Episode 306 to give you some more ideas on how to go about selecting a name, but then make sure that it’s available at the state level and that it hasn’t been already trademarked. Now, this relates to the step of determining and creating your legal entity for your business, certainly, there is no law against you operating as a sole proprietor, which means you are doing business in your name, and this is common for trades skills or tradesmen like electricians or other professionals where it’s just themselves, and so they operate as a sole proprietor, the argument being that it’s easier to manage, you don’t have the tax return to file for that legal entity, and it’s just easier to do it that way, and those things… True, but in my opinion, and in the opinion of many of the experts, attorneys included that I have interviewed on this podcast, and you can go to the legal group of episodes on the archives page to learn more, is that you do not want to operate as a sole proprietor, you want to create a legal entity now as to the type of legal entity, you need to get advice on that from either your CPA or a tax attorney, because every situation is different, it could be that an LLC is best for you, or a corporation might be a better tax structure for you, I can’t tell you which one is best for you, you need to get some advice from a CPA or a tax attorney, then you have to create that legal entity, and you essentially have three options to create the legal entity, let’s say, for example, that you’ve determined with the advice of a CPA that is going to be an LLC, a limited liability company, so entities, legal entities are created at the state level, every state manages that individually, and you can get advice, of course, also from your CPA as to which state you want to create the entity, and there’s a lot of considerations that come into play as to which state typically you will create your legal entity in the state within which you are conducting your business or your business is based…

0:30:00.6 HENRY LOPEZ: Or you are based yourself, once you determine the type of entity though, three options to create a… You can create it yourself, every state has a website and for a fee, and that fee ranges anywhere from 150 to a couple hundred dollars, it just depends on what state you’re in, and an online system that allows you to create it yourself, it’s not that complicated.

0:30:21.6 HENRY LOPEZ: But if you think it’s more than you can handle, then the other options, two options is you can go with an online service like Legal Zoom or others like that, where you pay a fee and they walk you step-by step online to help you create that entity and then the third option, which is the most expensive, so these were in order of expense.

0:30:41.4 HENRY LOPEZ: The third option is to hire an attorney to create that legal entity for you. Key take away, though on this item on the checklist of starting your business is you want to operate your business as a legal entity, not as a sole proprietorship, that gives you the best protection from a liability perspective, and also the best tax advantage is to create a legal entity instead of operating as a sole proprietor now, can you start as a… So proprietary and then create a legal entity, of course, just be aware, be well aware of the exposure of the potential liability exposure, if something happens and you were to get sued and you’re operating as a sole proprietor, then all of your personal assets potentially are at play here and they can go after. And so we want to protect ourselves from that possibility through a legal entity and through business insurance. Now, once we have the legal entity created, there are a couple of steps that need to happen, One is to get an EIN number and employer identification number, that’s essentially the equivalent of a social security number for businesses, and that’s created for you for free.

0:31:46.4 HENRY LOPEZ: Just takes a couple of minutes at a website that the IRS has, and I have a link to that on the checklist, download, so you create the in that just takes minutes, and then you’re ready to open a bank account, and I do highly recommend that you open a separate business bank account. For all of the financial transactions for this business, there are plenty of banks that offer business accounts to have no fees, and they give you online banking and all of those features to look for that you may wanna start obviously with your current bank. I encourage you to also apply for a business credit card, in addition to the debit card that you’ll essentially get by default, apply for a business credit card as well, and then once you get started and as soon as possible, you’ll transact all of the business, all of the financial transactions need to flow in and out of this checking account, you put personal money in to start and fund the business, or if the business needs more money, you make a deposit into that account, and then all of the expenses are paid out of that account and ideally either paid through a check or a transfer out of that account or using the business credit card or the debit card, everything flows through that account and a related business card as much as possible, or you’re trying to avoid is what’s called co-mingling of funds where what you have to be very careful is that if someone looks at your transactions that you’re paying personal bills out of the business account and vice a versa, the flow of money, sometimes people write you a check in the name of the business and other times in your personal name, sometimes it goes into the business account, sometimes it goes into your personal account, that’s called co-mingling of funds, and what can happen is that can allow the what’s called the piercing of the veil of the legal entity, which might expose you to legal or liability exposure, rather, of your personal assets, even if you are operating as an independent legal entity, so if I’ve confused you there, the takeaway is this, you want to operate your business as a separate legal entity, whether it’s an LLC or a corporation, you want to have a separate business checking account.

0:33:47.1 HENRY LOPEZ: And all of the financial transactions flow in and out of that checking account

0:33:52.3 HENRY LOPEZ: Related to managing all of that is setting up your bookkeeping and accounting, and this is where you want to consult with the CPA as well, but you wanna use a tool like QuickBooks or some other financial or accounting system tool, and you want to get help here, I encourage that you do this initially yourself, but this is never… You’re the focus of a business owner, these are things that have to happen in your business, but you need to be focused on selling and serving your customers, on developing new ideas, on moving the business forward, on running the business and then working on your business… The accounting and bookkeeping, you want to outsource as soon as it makes financial sense for you to do so to an online or a local bookkeeper or accounting service, there’s lots of options for you to consider to outsource this part of your business.

0:34:44.9 HENRY LOPEZ: This is every Lopes pausing this episode for a moment to tell you about my trusted service provider for a small business accounting, KPMG Spark. KPMG Spark is a managed accounting service that provides small and mid-sized businesses with bookkeeping accounting and tax preparation and payroll services all online for a simple low monthly fee. Now you can make more time for things that really matter in your business and let the experts at KPMG help you with your accounting. Most of us as small business owners are not experts in bookkeeping and accounting, and the accounting software solutions seem to have been developed for accountants and tax professionals, as a result, business owners often the collector accounting or spend endless hours trying to learn how to make it work, KPMG Spark is an online book-keeping and accounting service that saves you time so you can focus on what’s most important for your business.

0:35:37.7 HENRY LOPEZ: And with KPMG spark, you get a dedicated point first person from KPMG who is always available to help you simply pay a low monthly fee depending on the plan, you choose with no long-term commitment, and KPMG Spark currently has a special offer for the HOA business listeners, you get the regular onboarding fee wave, so visit the houses dot com for more information and the link to learn more and schedule your free consultation with KPMG Spark, and remember to let them know that you heard about it on the how a business podcast to receive this special offer.

0:36:16.9 HENRY LOPEZ: So now here we are ready to launch, I need to plan for that launch, and ideally, as I have recommended, you plan for your MVP 1 launch, version 1, the first iteration that you’ve niched down to the smallest possible version of this business idea and business model that you have, you’ve gotten your funding, you’ve Eline up the business, you’ve created your business plan, you’ve got your partners are lined up, you’re ready to go, ideally then now of course, you’re ready to hire employees, bring on wherever you’re going to bring on, whether it’s employees or contractors, you’re ready to get started.

0:36:53.5 HENRY LOPEZ: And my recommendation is, again, to start as small as possible, validate that, so you launch your product to your service and validate that there is a market and that people are willing to pay for this product or service, and then you’re going to iterate, you’re going to re-relaunch, if you have to, are you going to pivot and adjust as you need to develop this business now.

0:37:15.9 HENRY LOPEZ: That’s not always possible in all business scenarios, if you’re going to start a franchise, for example, you don’t get to do that, you will have validated to franchise and there’s a whole process there that I lay out in a whole series of episodes on what to consider with franchises, but if that’s the route you decide to take, that’s great, you will likely then have to start, of course, with a full-blown unit location of that franchise similarly, if you decided to buy a business, there is no MVP there, you’re going to start with that business as it is and then decide to take it in whatever direction you go with it, but if you’re building a business from scratch, here is an opportunity to start this way, you might start online and then go to a physical location, you might start with a very small iteration, a restaurant business is a good example of this, just so you that you can visualize it instead of signing that five-year lease for a restaurant space and spending all of the money on the equipment and to finish out and then hoping they will come, a lot of people will take the step of starting with a food truck or setting up a pop-up, maybe going into an incubator program to develop the concept and then get to the point after you’ve proven your concept and your menu and your recipe and your business model of leasing a space and taking it to that level of commitments.

0:38:34.1 HENRY LOPEZ: So there you have it, the 15 primary steps to consider to help you launch or for a small business, I encourage you to take it one step at a time. Don’t let it overwhelm you. When you look at everything that goes into starting a business, there’s a lot there, it’s a lot of work, a lot of different things to consider, a lot of different decisions to make, and if you look at it all together, it’s this huge mountain that’s going to see insurmountable, and it can paralyze you. So break it down a step at a time, as long as you’re making consistent progress, as long as you’re taking action every week, every day, if possible, a small step at a time.

0:39:08.7 HENRY LOPEZ: Break it down, take these steps one at a time, and that way you’ll look up some period of time down the road and you’ll be there, so don’t let it overwhelm you, make consistent, steady progress towards your goal, and everyone is on the unique path for you, it might be sooner or later than someone else… That’s okay, there might be some things that you need to take care of first that might take you a little longer and then enjoy the journey. I used to get really hung up on this, that I only celebrated success if I got to this arbitrary ideal external measure of what that meant in business, instead, enjoy the process, enjoy the journey of building your business, it should be fun, to some extent it’s hard work but be passionate about it.

0:39:52.6 HENRY LOPEZ: If you’re not, then that might tell you something that maybe you’re not ready yet, or you’re not thinking of the right idea.

0:39:58.8 HENRY LOPEZ: So enjoy the whole process, even the building stages that you’re in now, and I encourage you to leverage all of the resources that are available to you at the holiness dot com, including the free business start-up checklist and the other downloads that I’ve mentioned in this episode of their previous episodes of The how business. And be sure to join me for the next financial projections workshop.